NYC Rideshare Drivers: Your 2026 Tax Guide

Published on January 15, 2026

Master estimated quarterly taxes, deductions, and compliance requirements for TLC drivers on Uber, Lyft, and other platforms in 2026.

# NYC Rideshare Drivers: Your 2026 Tax Guide

As a TLC driver in New York City, managing your taxes is one of the most critical aspects of running your rideshare business. Whether you drive for Uber, Lyft, or another for-hire vehicle platform, understanding your tax obligations, deductions, and compliance requirements can save you thousands of dollars annually. With the NYC TLC continuing to strengthen regulatory oversight in 2026, now is the time to get your tax strategy in order.

This comprehensive guide will walk you through everything you need to know about filing taxes as a rideshare driver in New York City for 2026.

Understanding Self-Employment Taxes

As a rideshare driver, you're not an employee of Uber, Lyft, or any other platform. You're classified as a self-employed independent contractor, which means you're responsible for paying both the employer and employee portions of Social Security and Medicare taxes.

Self-employment tax is calculated at 15.3% of your net business income, broken down as follows:

- 12.4% goes to Social Security

- 2.9% goes to Medicare

- An additional 0.9% Medicare tax applies to income over certain thresholds

This is significantly different from traditional employment, where your employer covers half these costs. As a self-employed driver, you bear the full burden, which is why understanding your deductions is absolutely critical to reducing your tax liability.

The Importance of Estimated Quarterly Taxes

One of the biggest mistakes NYC rideshare drivers make is waiting until April to address their taxes. The IRS expects self-employed individuals to pay estimated quarterly taxes throughout the year, not just once annually.

Estimated quarterly tax payments are due on:

- April 15 (for income earned January through March)

- June 15 (for income earned April through May)

- September 15 (for income earned June through August)

- January 15 (for income earned September through December)

Missing these payments can result in penalties and interest charges. To calculate your estimated quarterly taxes, you'll need to:

1. Estimate your total net profit for the year

2. Calculate your self-employment tax

3. Estimate your income tax based on your tax bracket

4. Divide by four for quarterly payments

Many successful TLC drivers set aside a percentage of each week's earnings (typically 25-30%) specifically for taxes. This simple habit prevents the shock of a large tax bill and keeps you compliant with IRS requirements.

Critical Deductions for TLC Drivers

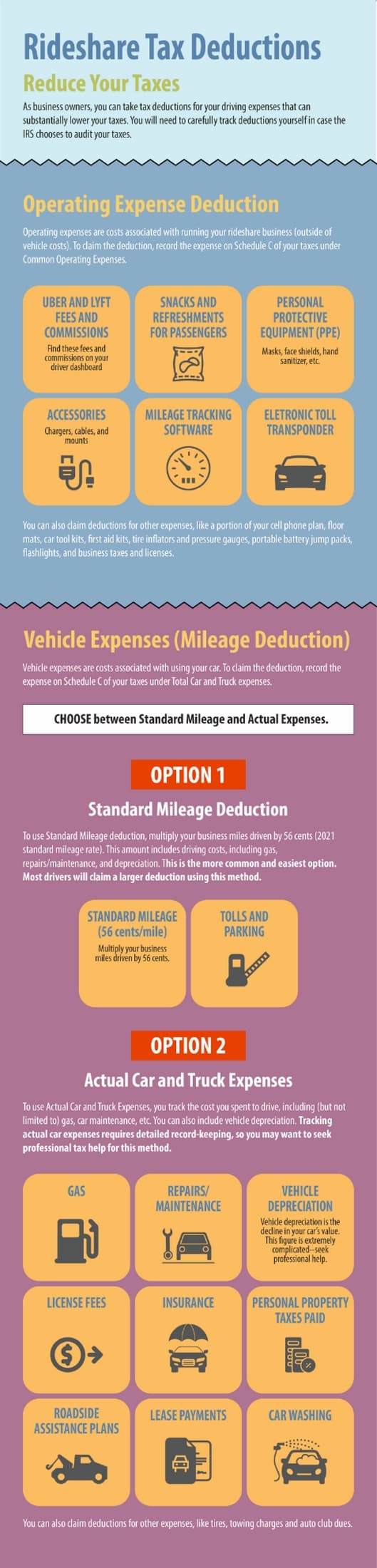

As a for-hire vehicle operator in New York City, you have access to substantial deductions that can significantly lower your taxable income. Understanding and properly documenting these expenses is essential.

Vehicle Expenses

You have two methods for calculating vehicle deductions:

Standard Mileage Method: For 2024, the IRS allows $0.67 per business mile driven. This simplified approach requires you to track your total miles driven for rideshare purposes. Simply multiply your business miles by the standard mileage rate and claim the deduction on your Schedule C.

Actual Expense Method: This approach allows you to deduct the real costs of operating your vehicle, including:

- Gas and fuel

- Vehicle maintenance and repairs

- Oil changes and tire replacements

- Vehicle insurance (commercial coverage)

- Vehicle registration and inspection fees

- Lease or loan payments

- Depreciation (if you own the vehicle)

- Parking fees and tolls related to rideshare work

Many NYC drivers find the actual expense method more beneficial, particularly given the high costs of operating a vehicle in New York City. Track every expense meticulously throughout the year to maximize these deductions.

TLC License and Permit Fees

Don't overlook one of the most obvious deductions available to NYC taxi and rideshare drivers: your TLC license plate fee and any related permits. The TLC requires all for-hire vehicle operators to maintain current licensing, and these costs are 100% deductible as a business expense.

Include:

- Annual TLC license plate fees

- Airport pickup permits

- Any special service authorizations

- License renewal costs

Other Deductible Business Expenses

Beyond vehicle costs, you can deduct numerous other legitimate business expenses:

- Phone and internet: The portion used for rideshare business (tracking rides, communicating with passengers, monitoring the app)

- Vehicle cleaning: Professional car washes and detailing services

- Office supplies: Phone mounts, dash cams, chargers, notebooks for record-keeping

- Professional services: Accounting or tax preparation fees

- Vehicle equipment: Safety equipment, first aid kits, emergency supplies

- Advertising: If you promote your services independently

- Education: TLC-approved safety courses or defensive driving classes

The key to maximizing deductions is maintaining detailed records. Use a spreadsheet, accounting app, or dedicated expense tracker to document every business-related expense. This documentation is crucial if the IRS ever audits your return.

Filing Your Taxes: Key Forms and Schedules

When you file your annual tax return as an NYC rideshare driver, you'll need to complete several forms beyond the standard Form 1040.

Schedule C: Profit or Loss from Business

Schedule C is where you report your rideshare income and business expenses. This form is central to your tax filing as a self-employed driver. You'll report:

- Your gross income from rideshare platforms

- All business deductions and expenses

- Your net profit or loss

The net profit from Schedule C flows to your Form 1040, where it's included in your overall taxable income.

Schedule SE: Self-Employment Tax

Schedule SE is used to calculate your self-employment tax obligation. This form takes your net profit from Schedule C and applies the 15.3% self-employment tax rate, with adjustments for the deductible portion of self-employment tax.

1099-NEC and 1099-K Forms

By the end of January 2026, Uber, Lyft, and other platforms are required to send you tax documentation. You may receive:

- Form 1099-NEC (Nonemployee Compensation): Reports amounts paid to you

- Form 1099-K (Payment Card Transactions): Reports payment card transactions above certain thresholds

Review these forms carefully. If they contain errors, contact the issuing platform immediately to request corrections. Keep copies for your records and reference when preparing your return.

NYC TLC Regulatory Changes for 2026

The NYC Taxi & Limousine Commission released its Fiscal Year 2026 Regulatory Agenda, which includes several important developments affecting rideshare drivers.

Strengthened Data Submission Requirements

The TLC is working to require high-volume for-hire services (Uber, Lyft) to submit trip data more frequently than the current bi-weekly schedule. This change aims to improve the agency's enforcement capabilities and provide drivers with faster access to earnings information for verification purposes.

For tax purposes, this means more frequent and detailed earning records will be available through your driver dashboard. These records are essential for accurately reporting your income and substantiating any disputes about payments.

Driver Pay Protections and Compliance

The TLC continues to focus on driver pay standards, ensuring that platforms provide:

- Clear, itemized payment statements

- Transparency regarding deductions and charges

- Quick payment of driver earnings

- Minimum per-trip payment protections

As a driver, ensure you're receiving the minimum compensation required by TLC rules. If you believe you're not being paid fairly, use the TLC Driver Pay Calculator available on the agency's website, or contact the Driver Protection Unit at DriverProtection@tlc.nyc.gov.

For tax purposes, accurate payment records from your rideshare platform are crucial. These documents support your reported income and help substantiate any discrepancies should you face an audit.

Record-Keeping Best Practices

Proper record-keeping is the foundation of accurate tax filing and reduced audit risk. Implement these practices throughout 2026:

Mileage Tracking

Maintain a mileage log documenting:

- Date of trips

- Starting and ending odometer readings

- Business purpose (rideshare trips)

- Total miles driven

Your rideshare app typically provides some of this information, but supplementing with your own records strengthens your documentation.

Expense Documentation

For every business expense, keep:

- Receipts (digital or physical)

- Dates of purchases

- Descriptions of items or services

- Categories (fuel, maintenance, insurance, etc.)

- Business purpose documentation

Many drivers use apps like Stride Health, QuickBooks Self-Employed, or even simple spreadsheets to organize these documents. The IRS doesn't require a specific format, only that records be organized, accessible, and substantiating.

Platform Statements

Download and save detailed earnings statements from Uber, Lyft, and other platforms monthly. These statements show:

- Total trips completed

- Gross earnings

- Platform fees and deductions

- Net payments received

These documents are invaluable for verifying your reported income and addressing any discrepancies.

Tax Planning Strategies for 2026

Maximize Your Deductions

Don't leave money on the table. Review the complete list of deductible expenses and ensure you're capturing everything:

- Are you claiming all vehicle-related expenses?

- Have you tracked all phone and internet costs?

- Did you document professional services and fees?

- Have you kept receipts for supplies and equipment?

A few hundred dollars in overlooked deductions might seem minor, but they accumulate throughout the year and significantly impact your bottom line.

Consider a Retirement Plan

As a self-employed NYC driver, you're eligible to establish a SEP IRA or Solo 401(k). These retirement accounts allow you to save a portion of your profits while reducing your taxable income. Contributions made in 2026 can substantially lower your tax liability for that year.

Timing of Major Expenses

If you're planning significant vehicle repairs, maintenance, or equipment purchases, consider timing them strategically within your tax year. These expenses reduce your taxable income, and timing can help distribute deductions across multiple years if beneficial for your overall tax picture.

Entity Structure Considerations

While most rideshare drivers operate as sole proprietors, some with higher incomes may benefit from forming an S-Corporation. This more complex structure can reduce self-employment taxes but involves additional administrative requirements. Consult with a tax professional to determine if this structure makes sense for your specific situation.

Working With a Tax Professional

Given the complexity of self-employed taxes, many successful TLC drivers work with tax preparation professionals or certified tax advisors. The investment in professional guidance often pays for itself through optimized deductions and strategic planning.

When selecting a tax professional, look for:

- Experience with self-employed individuals and rideshare drivers

- Familiarity with NYC TLC regulations

- Knowledge of current tax laws and deductions

- Availability for quarterly tax planning consultations

A good tax professional doesn't just prepare your return once annually; they help you plan throughout the year, maximizing your deductions and minimizing your overall tax burden.

Common Tax Mistakes to Avoid

Failing to Report All Income

While some drivers think unreported cash tips or payments between platforms constitute "hidden income," the IRS expects complete reporting of all earnings. Maintain records of all income sources and report everything on your tax return.

Mixing Personal and Business Expenses

Only deduct expenses directly related to your rideshare business. Personal groceries, entertainment, or family expenses are not deductible, even if you occasionally work from home. Commingling personal and business expenses raises audit red flags.

Inadequate Documentation

Don't rely on memory for deductions. Keep contemporaneous records with receipts, dates, and business purpose documentation. The IRS may disallow deductions that lack proper substantiation.

Missing Quarterly Payments

Wait until April to address taxes and you'll face penalties and interest. Commit to making quarterly estimated tax payments throughout the year.

Conclusion

As a TLC driver in New York City, your tax obligations are significant, but so are your deduction opportunities. By understanding self-employment taxes, maintaining meticulous records, maximizing deductions, and staying compliant with NYC TLC regulations, you can substantially reduce your tax liability while positioning yourself for long-term financial success.

The 2026 tax year brings new regulatory developments from the NYC TLC, making it even more important to stay organized and informed. Start your tax planning now, track your expenses diligently, and consider working with a tax professional to optimize your strategy.

Your rideshare business deserves the same professional financial management as any other enterprise. With proper tax planning and compliance, you can maximize what you keep and ensure a sustainable livelihood driving for Uber, Lyft, and other platforms in New York City.